Key Details on ixigo IPO Opening June 10

2 min read

ixigo IPO Open: The company raised Rs 333.05 crore from the anchor investors by offering them 35.8 million shares. (Image: Website/ixigo)

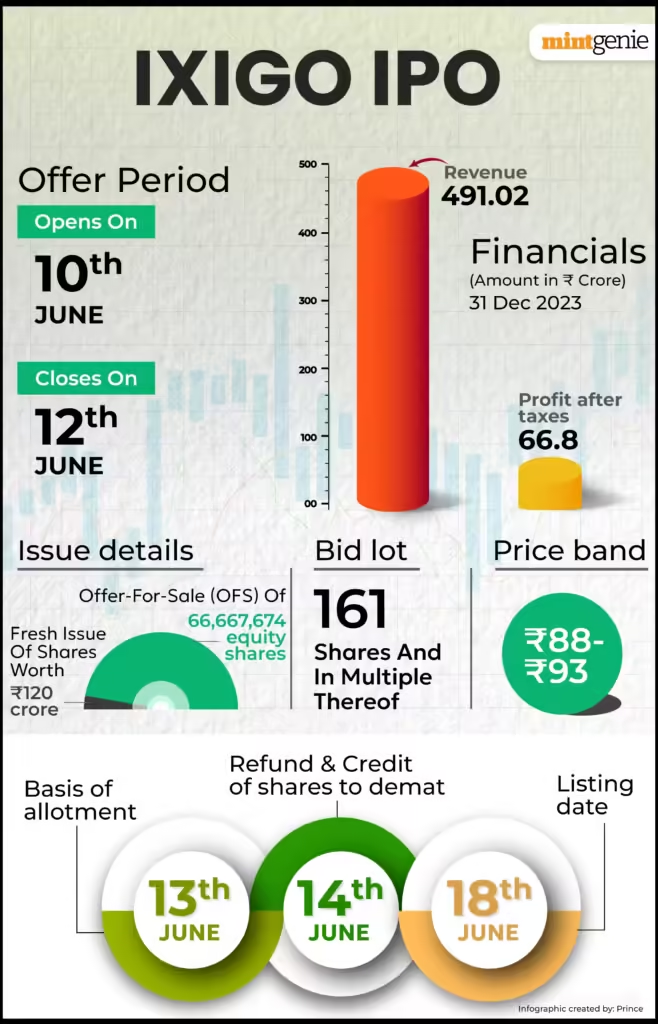

The online travel agency ixigo (Le Travenues Technology) opened its IPO on June 10, aiming to raise Rs 740.10 crore. The company is offering 79.6 million shares through a combination of a fresh issue and an offer for sale. Specifically, ixigo will raise Rs 120 crore by issuing 12.9 million fresh shares. The majority of the proceeds, Rs 620.10 crore, will go to promoters and other selling shareholders who are offloading 66.7 million shares.

The IPO will close on June 12. The issue price is set between Rs 88 to Rs 93 per equity share. Retail investors must apply for a minimum of one lot, containing 161 shares, totaling Rs 14,973. Different allotment sets are available for Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs).

Here are 10 important factors to consider before subscribing to the Ixigo IPO –

Ixigo IPO date: The IPO will remain open for subscription on June 10 and will close to June 12.

Ixigo IPO price band: The price band of the online travel portal has been fixed at ₹88 to ₹93 per share.

Ixigo IPO size: The Gurugram-based ixigo IPO comprises a fresh issue of equity shares valued at ₹120 crore and an Offer For Sale (OFS) of 6.66 crore equity shares worth ₹620 crore by existing shareholders at the upper end of the price band.

Ixigo IPO lot size: Investors can place bids for a minimum of 161 shares and in multiples of that amount. The minimum investment required from retail investors is ₹14,973.

Ixigo IPO promoters: The promoters of Le Travenues Tech Ltd who will be selling shares through the Ixigo IPO include SAIF Partners India IV Ltd, Peak XV Partners Investments V (formerly SCI Investments V), Micromax Informatics Ltd, Placid Holdings, Catalyst Trusteeship Ltd, Madison India Capital HC, Aloke Bajpai, and Rajnish Kumar.

Ixigo IPO allotment date: The allotment of the upcoming IPO is anticipated to be finalized on Thursday, June 13, 2024.

Ixigo IPO listing date: The IPO is scheduled to be listed on both the BSE and NSE, with a tentative listing date set for Tuesday, June 18, 2024.

Ixigo IPO registrar: Link Intime India Private Ltd is the registrar for the issue.

Ixigo IPO book-running managers: The book-running lead managers of the IPO are Axis Capital Limited, Dam Capital Advisors Ltd (Formerly Idfc Securities Ltd) and Jm Financial Limited.

Ixigo IPO GMP: The shares of ixigo IPO are available at a premium of ₹23 in the grey market premium (GMP), as per investorgain.com.

Stay Updated: Visit Our Page for the Latest Trending News