FM Sitharaman to Present Union Budget 2024-25 on Tuesday: Schedule, Highlights, and Sector Expectations

2 min read

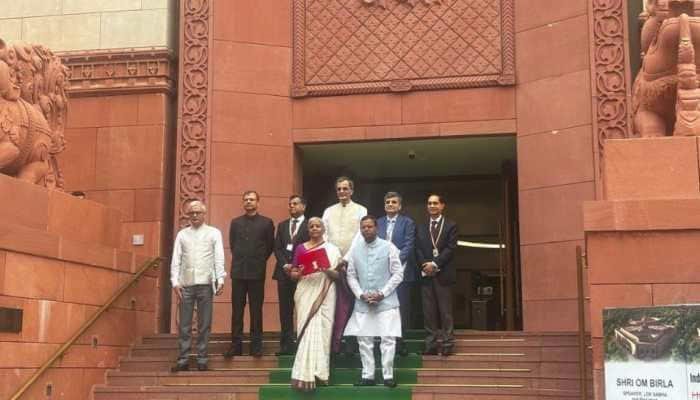

Union Budget 2024: FM Sitharaman Dons White And Magenta Saree For Budget Presentation

Finance Minister Nirmala Sitharaman will present the Union Budget 2024-25 in the Lok Sabha on Tuesday, July 23. This will be her seventh consecutive budget, making her the second finance minister after C D Deshmukh to achieve this milestone. As the first budget of the Modi 3.0 government, it is anticipated to drive initiatives across various economic sectors in line with the Viksit Bharat 2047 Vision while maintaining fiscal prudence.

Budget 2024

The nation eagerly anticipates the presentation of the Union Budget by Finance Minister Nirmala Sitharaman. Besides the financial announcements, her attire always garners attention. Each year, Sitharaman’s saree selection for the budget presentation becomes a point of public interest and admiration.

For her seventh Union Budget presentation, a record-breaking occasion, Sitharaman wore a stunning white silk saree with a magenta border and intricate golden motifs. Her elegant look drew widespread admiration across the country and on social media.

Budget Expectations on Income Tax

Anticipation surrounds potential income tax changes from Finance Minister Nirmala Sitharaman, including increases in exemption and standard deduction limits.

Single Hybrid Tax Regime: The government might move towards a ‘Single Hybrid Tax Regime’ as new taxpayers are already following the new system. The exemption threshold in the new regime is expected to rise from the current ₹3 lakh to at least ₹4 lakh.

Incentives for Old Regime Taxpayers: Established taxpayers with incomes exceeding ₹15 lakh often favor the old regime. The government may offer incentives to encourage them to switch to the new regime, possibly introducing a new tax slab for incomes between ₹15 lakh and ₹18 lakh with a 25% tax rate.

Standard Deduction: The finance minister is also anticipated to increase the standard deduction for salaried taxpayers to ₹1 lakh.

Real Estate Sector

The real estate sector is optimistic about the upcoming budget, hoping for tax reliefs, affordable housing initiatives, and land-related announcements.

Industry Status: The sector is pushing for ‘industry’ status to attract investments and streamline regulations.

Interest Deduction on Housing Loans: A key demand is increasing the interest deduction limit on housing loans under Section 24B from ₹2 lakh to ₹5 lakh.

Holding Period for Capital Gains: The government may reduce the holding period for capital gains on real estate from 24 months to 12 months and lower the long-term capital gains tax rate from 20%.

Affordable Housing Criteria: There is a push to raise the cost, size, and income criteria for affordable housing to make it more inclusive.

Budget Expectations from Industries, Including MSMEs

The government is concentrating on promoting clean technologies and fostering the growth of industries, particularly startups and MSMEs.

Infrastructure and Production Costs: The industry anticipates government efforts to enhance infrastructure and reduce production costs for MSMEs. Necessary measures include upgrading power infrastructure in industrial areas and further simplifying labor laws.

Compliance and Clearances: There are also expectations for streamlining pollution control clearances and lowering compliance costs.

Stay Updated: Visit Our Page for the Latest Trending News